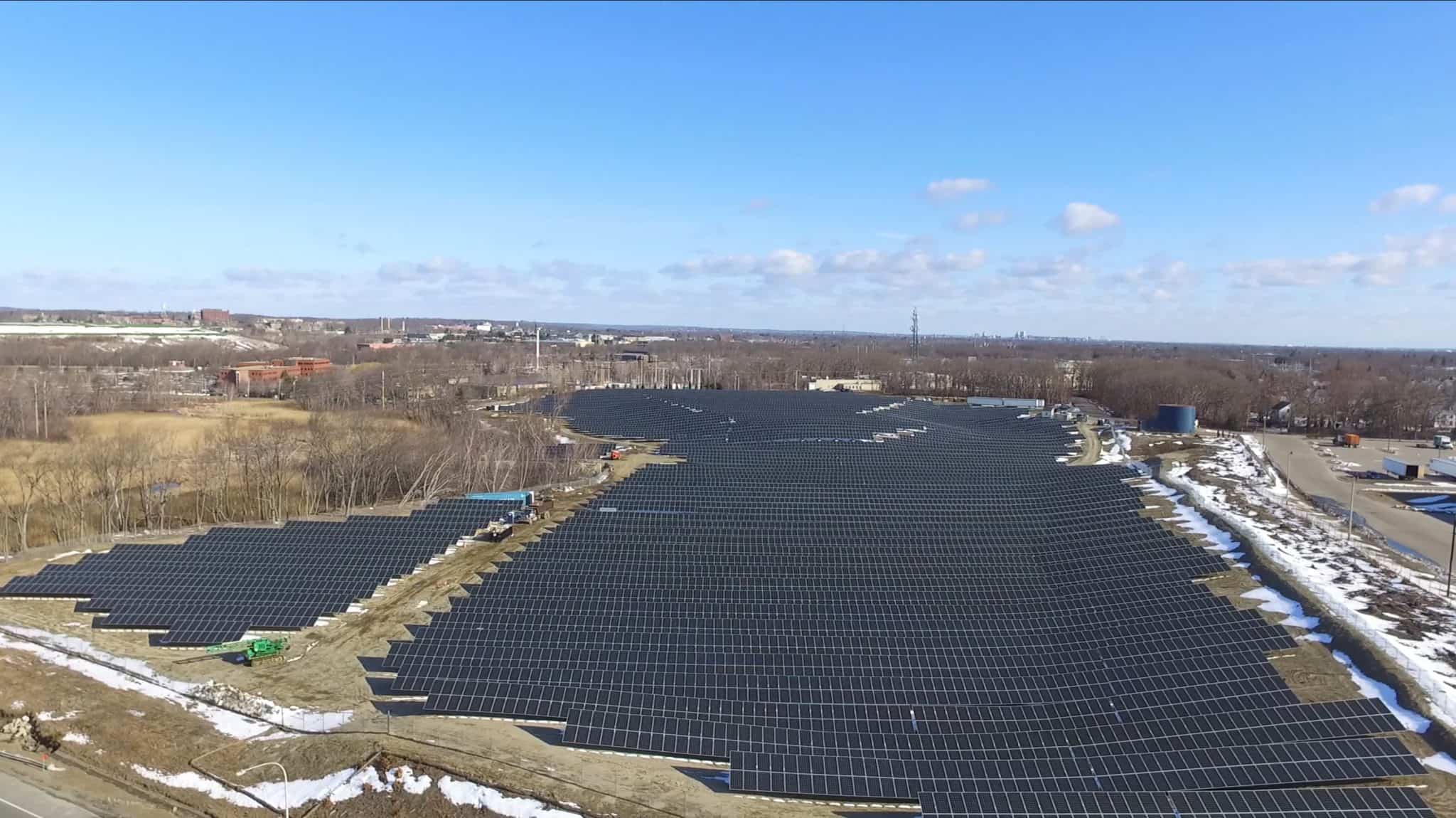

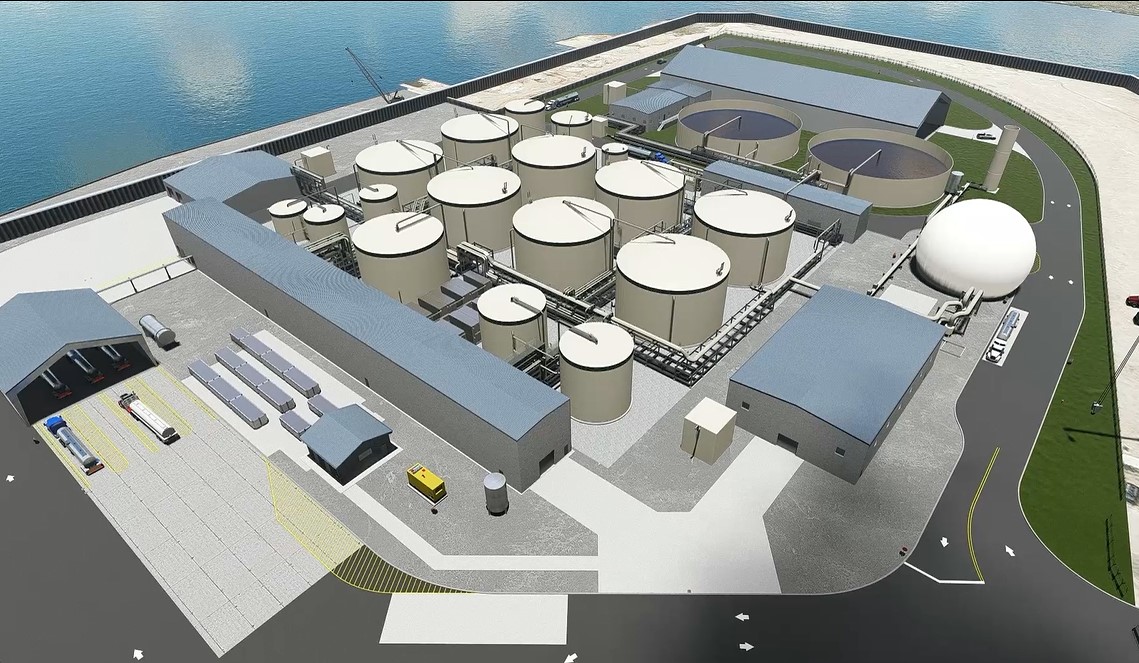

December 20, 2023 — Captona, SJI, and RNG Energy Solutions today announce their partnership to construct one of the largest food waste-to-renewable natural gas (RNG) projects in the United States. The Linden Renewable Energy (LRE) Project, based in Linden, NJ will convert organic waste into pipeline-quality RNG that can be used for a variety of applications to displace fossil fuels.

The LRE Project will accept a wide range of feedstock, including food waste from industrial, commercial, and institutional entities, as well as grease waste from restaurants and other food service establishments. Anaerobic digestion is a natural process that breaks down waste in the absence of oxygen to produce natural gas and a nutrient-rich material that can be used as fertilizer.

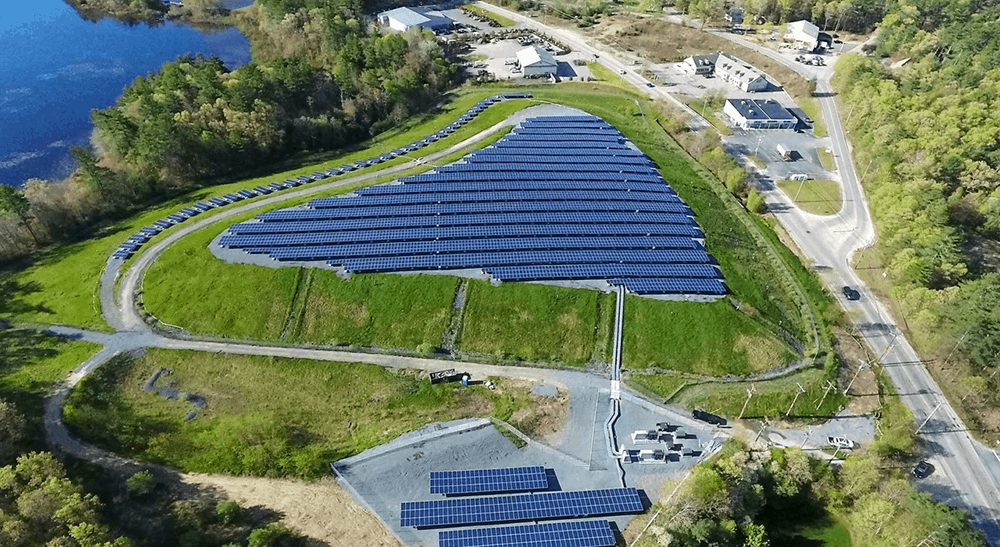

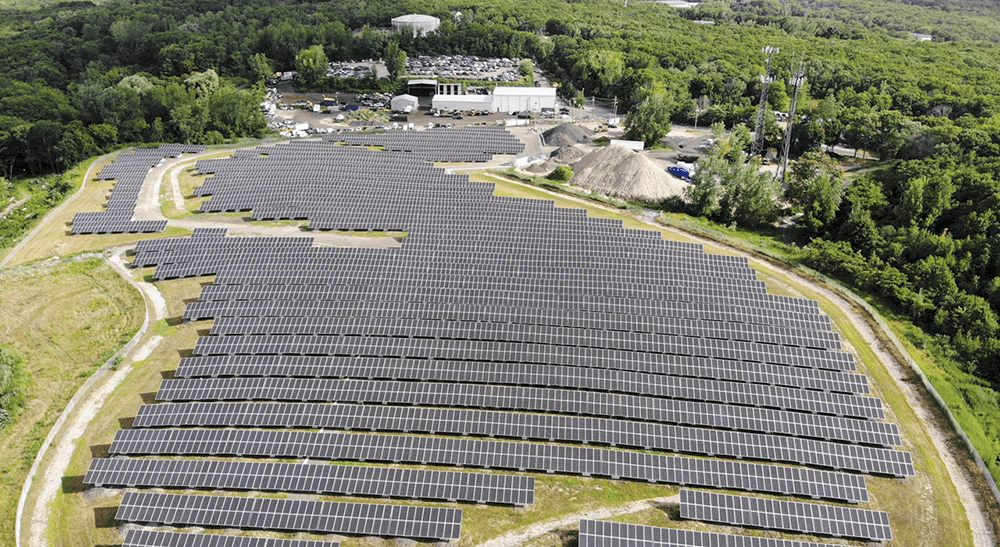

As a result, the LRE Project will convert up to 1,475 tons of waste to produce up to 3,783MMBtu/day of RNG. The LRE Project includes development and construction of multiple off-site food waste pre-processing and depackaging operations in New York City, New York State and New Jersey.

“Captona recognizes this marquee investment in this food waste-to RNG plant in New York City and the New Jersey area as a major milestone in the growth of its Energy Transition Infrastructure portfolio of Fuel Cell, RNG, Solar and Storage projects” said Captona’s Founder and CEO, Izzet Bensusan. “This project will greatly contribute to reducing emissions and upcycling food waste.”